Bad credit payday lenders help those with low or poor credit scores get quick access to emergency cash when traditional banks aren’t an option. In 2025, these digital-first lenders have become even more vital as consumers face tightening regulations and a shrinking pool of no-credit-check platforms.

What Are Bad Credit Payday Lenders?

Bad credit payday lenders provide short-term loans and cash advances to people who don’t qualify for standard loans due to a low credit score or limited credit history. Their focus is on speed, online applications, and approval based on employment or income rather than strong credit. Funding is often same-day or within minutes.

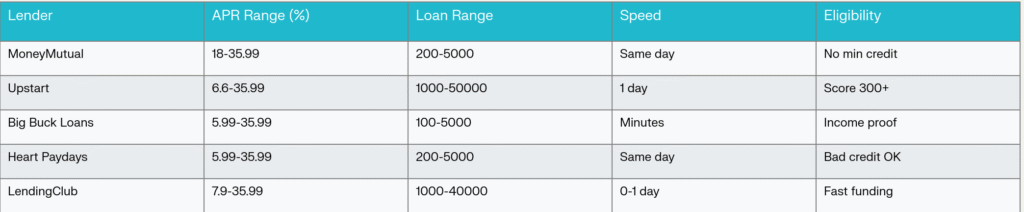

Top Bad Credit Payday Lenders (2025): Features & Comparison

These lenders include platforms such as:

MoneyMutual: No minimum credit, rapid online form, matches to multiple lenders.

Upstart: Approves applicants with credit scores as low as 300 or even no credit, AI-powered risk models for fast approval.

Big Buck Loans and Heart Paydays: Welcomes self-employed, bad credit, or new borrowers with flexible loan amounts.

LendingClub: Known for fast funding and working with moderate-score applicants.

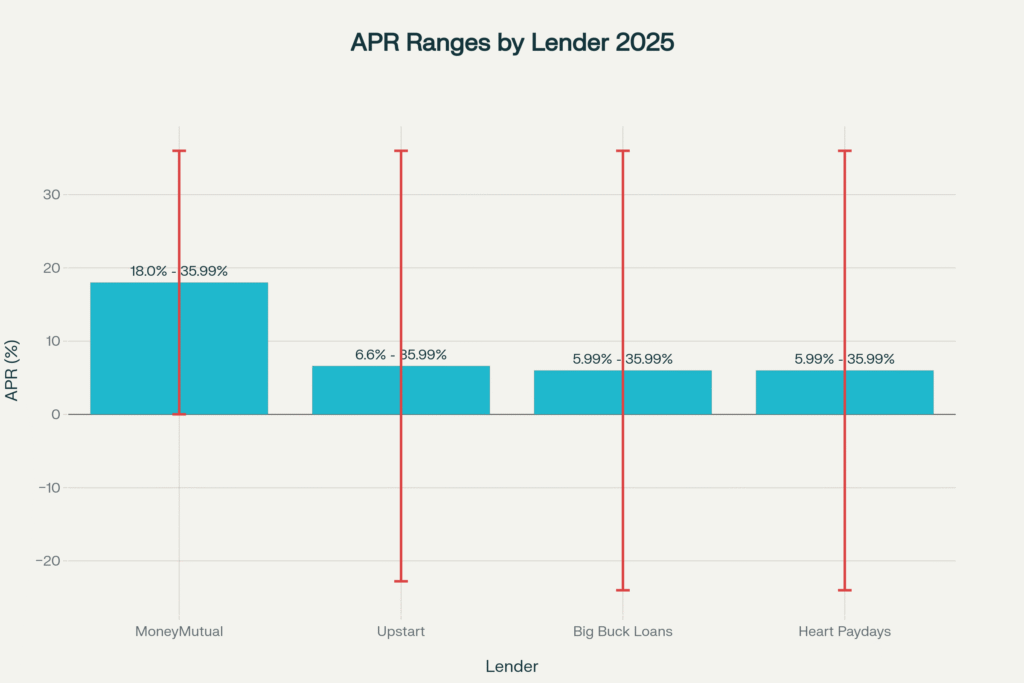

APR Comparison: Bad Credit Payday Lenders

All options offer high APRs compared to traditional loans (often 6.60%–35.99%).

Lenders that work with no credit or very poor scores tend to have the highest interest rates, reflecting the greater risk.

Eligibility & Application Process

Eligibility requirements are minimal:

Proof of income (job or steady cash inflow)

US citizenship or valid residency

Age 18+ and a checking account

Broad approval—many don’t require a hard credit inquiry at all

Apply online in minutes, receive a decision almost instantly, and funds are often available the same business day or even in real-time for some lenders.

Eligibility Criteria

Most direct lenders require:

Age 18+ years

Proof of regular income

US citizenship or permanent residency

Active bank account

Pros & Cons of Bad Credit Payday Lenders

Pros:

Accessible to poor-credit and even no-credit borrowers

Super-fast funds, sometimes in 15 minutes

Minimal documentation and no paperwork

Flexible use—pay bills, rent, or emergencies

Cons:

High-cost: interest rates are typically much higher than bank loans

Short repayment terms (often due on your next payday)

Small loan amounts, especially for first-time borrowers

How to Boost Approval Odds & Borrow Responsibly

- Complete the application honestly and upload clear proof of income

- Borrow only what’s needed; payday loans can be expensive

- Repay on time to avoid rollover penalties and further credit damage

- Compare lenders closely on fees, APR, and funding speed

Conclusion

Bad credit payday lenders in 2025 serve as a critical financial resource for people facing emergencies and denied by banks. With fast online applications, broad eligibility, and rapid funding, these platforms offer a practical—if high-cost—alternative for those with imperfect credit. Always use these loans responsibly and compare terms to avoid unnecessary financial stress.

“Even if we do not talk about 5G (specifically), the security talent in general in the country is very sparse at the moment. We need to get more (security) professionals in the system”