Borrowers can access no credit check loans with guaranteed approval from direct lenders by targeting online platforms specializing in fast, accessible funding for those with poor or nonexistent credit histories. Below is an in-depth guide on how these loans work and how applicants can leverage direct lender options for urgent financial needs

What Are No Credit Check Loans (Guaranteed Approval)?

No credit check loans are personal loans that do not require a hard credit inquiry for approval, focusing instead on income and employment status. Such loans appeal to borrowers who have been rejected by traditional lenders due to weak credit or no credit history. Direct lenders are financial institutions or licensed online lenders who process, approve, and fund loans directly without brokers, often enabling faster decisions and more flexible terms.

Key Features of Direct Lender No Credit Check Loans

No hard credit inquiry during application

Approval based on income, age, and residency—not past credit scores

Guaranteed approval for eligible borrowers with documented income

Fast payout, often within hours

Loan amounts typically range from $100 to $5,000 for payday loans and up to $10,000 for personal loans

Repayment options include weekly, bi-weekly, or monthly installments

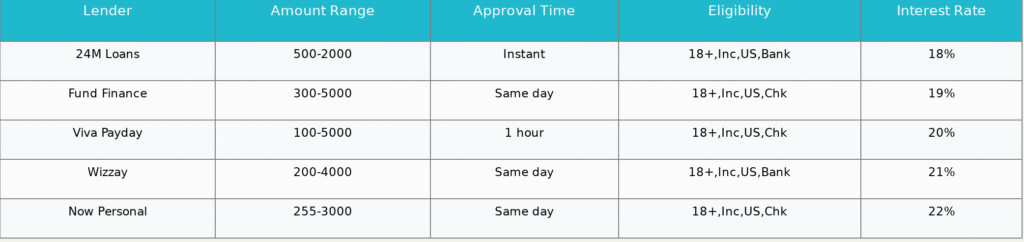

Top Direct Lenders: Loan Features Comparison

This table compares major direct lenders online, showing their policies for no credit check guaranteed approval loans:

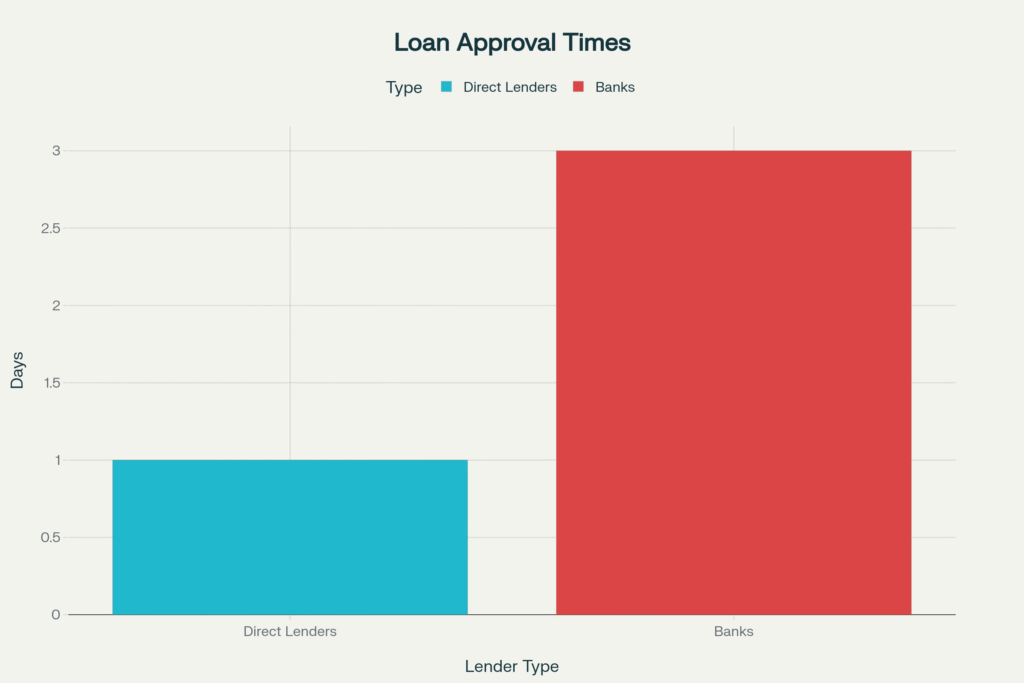

Average Approval Time: Direct Lenders vs Banks

Direct lenders typically approve loans within 1 business day, compared to 3 days from banks, making them ideal for emergencies:

How to Get a No Credit Check Loan with Guaranteed Approval

- Apply directly on lender websites such as Viva Payday Loans, Fund Finance, or Now Personal Loan

- Fill in personal details, income information, and loan amount requested

- No hard credit pull; approval is based on proof of regular income, age (18+), and citizenship/residency

- Choose from offers matched instantly with direct lender platforms

- Receive funds, often the same day, in a checking or savings account

Eligibility Criteria

Most direct lenders require:

Age 18+ years

Proof of regular income

US citizenship or permanent residency

Active bank account

Pros and Cons of No Credit Check Direct Lender Loans

Advantages

Accessible for borrowers with bad credit or no credit history

Fast approval and funding

Flexible repayment terms (weekly to monthly)

Transparent terms and direct communication with lender

Disadvantages

Higher interest rates, with APRs ranging from 18% to 22%

Lower initial loan amounts for first-time borrowers

Potential fees for late payments or rollover

Expert Tips to Get Approved

Maintain steady income and provide accurate pay documentation

Choose direct lenders with strong user reviews and transparent terms

Only ask for what is needed to maximize approval odds and avoid high costs

Conclusion

Securing a loan from a direct lender with no credit check and guaranteed approval is a viable solution for those needing emergency cash but lacking strong credit, provided the applicant has stable income and meets basic criteria. Compare features using lender tables, focus on direct application portals, and review terms carefully for quick access to funds.

“Even if we do not talk about 5G (specifically), the security talent in general in the country is very sparse at the moment. We need to get more (security) professionals in the system”